The 2018 budget would provide a 50 income tax exemption on rental income earned by Malaysian resident individuals effective from YA 2018 to 2020. Assessment Year 2020 Assessment Year 2019 Assessment Year 2018 Assessment Year 2017 Assessment Year 2016.

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

Whats people lookup in this blog.

. The following list illustrates the income tax rate for each taxable income group from the year 2010 assessment onwards. Keep in mind that the income group definitions are not fixed. Income attributable to a Labuan business.

12 rows Chargeable Income. Reduction of certain individual income tax rates. Malaysia personal income tax guide 2019 ya 2018 money malay mail the gobear complete guide to lhdn income tax reliefs malaysia malaysia personal income tax rates table 2017 updates taxplanning budget 2018 wish list the edge markets.

Whats people lookup in this blog. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to RM34500. The names B40 M40 and T20 represent percentages of the countrys population of Bottom 40 Middle 40 and Top 20 respectively.

Masuzi December 15 2018 Uncategorized Leave a comment 7 Views. 1 Corporate Income Tax 11 General Information Corporate Income Tax. The relevant proposals from an individual tax perspective are summarized below.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. 20182019 Malaysian Tax Booklet 7 Scope of taxation Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or insurance which is assessable on a world income scope. Reduction of certain individual income tax rates.

Special tax rates apply for companies resident and incorporated in Malaysia with an ordinary paid-up share. Malaysia Corporate Tax Rate 2018 Table. The amount of tax relief 2018 is determined according to governments graduated scale.

On the First 5000. Corporate tax rates for companies resident in Malaysia is 24. Tax Rate Table 2018 Malaysia.

Calculations RM Rate TaxRM 0-2500. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. Malaysian Government imposes various kind of tax relief that can be divided into tax payer self dependent parents and many more with the.

23 rows Tax Relief Year 2018. Malaysian Income Tax Rate 2018 Table. The 2018 national budget was announced by Malaysias Minister of Finance on 27 October 2017.

Income tax how to calculate bonus and free malaysia today malaysia personal income tax guide 2019 ya 2018 money malay mail malaysia personal income tax rates table 2017 updates 85 info tax exemptions malaysia 2019. Income Tax Withholding Tables 2019. Thats a difference of RM1055 in taxes.

Income Tax Rate Table 2018 Malaysia. For little and medium venture SME the main RM500000 Chargeable Income will be impose at 18 and the Chargeable Income above RM500000 will be assess at 24 subject to decrease of expense rate for increment in chargeable salary. Masuzi December 14 2018 Uncategorized Leave a comment 0 Views.

Tax relief refers to a reduction in the amount of tax an individual or company has to pay. Calculations RM YA 2017 Rate YA 2018 Rate YA 2017 Tax RM YA. Income tax how to calculate bonus and personal tax archives updates malaysian tax issues for expats audit tax accountancy in johor bahru.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. Income range for T20 M40 dan B40 in 2019 dan 2016. You can check on the tax rate accordingly with your taxable income per annum below.

Calculations RM Rate TaxRM. This would enable you to drop down a tax bracket lower your tax rate to 3per cent and reduce the amount of taxes you are required to pay from RM1640 to RM585. On the First 2500.

4360 9619. Malaysian Income Tax Rate 2018. Income Tax Rate Table 2018 Malaysia.

Income Tax How To Calculate Bonus And Free Malaysia Today Fmt. But tax is a. The relevant proposals from an individual income tax Malaysia 2018 perspective are summarized below.

Tax Rate Table 2018 Malaysia. Assessment Year 2018-2019 Chargeable Income. The values may increase or decrease year-to-year.

Malaysia Personal Income Tax Rate is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a max of 28. Home Uncategorized Malaysia Corporate Tax Rate 2018 Table. 11 rows This overview of the Malaysian income tax system is a great starting point.

A qualified person defined who is a knowledge worker residing in Iskandar Malaysia is taxed at the rate of 15 on income from an employment with a designated company engaged in a qualified activity in that specified region. Taxplanning budget 2018 wish list audit tax accountancy in johor bahru comparing tax rates across asean malaysian tax issues for expats.

What You Need To Know About Payroll In Malaysia

Malaysians Pay Over Rm 10 Billion In Car Taxes Every Year How Did We End Up Like This Wapcar

Income Tax Malaysia 2018 Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysia Sst Sales And Service Tax A Complete Guide

Income Tax Malaysia 2018 Mypf My

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

How Train Affects Tax Computation When Processing Payroll Philippines

Income Tax Malaysia 2018 Mypf My

Malaysia Personal Income Tax Rate Tax Rate In Malaysia

Income Tax Malaysia 2018 Mypf My

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

Global Distribution Of Revenue Loss From Tax Avoidance Re Estimation And Country Results Eutax

Malaysian Bonus Tax Calculations Mypf My

10 Things To Know For Filing Income Tax In 2019 Mypf My

Malaysia Payroll And Tax Activpayroll

Tax Rates In South East Asia Philippines Has Highest Tax Hrm Asia Hrm Asia

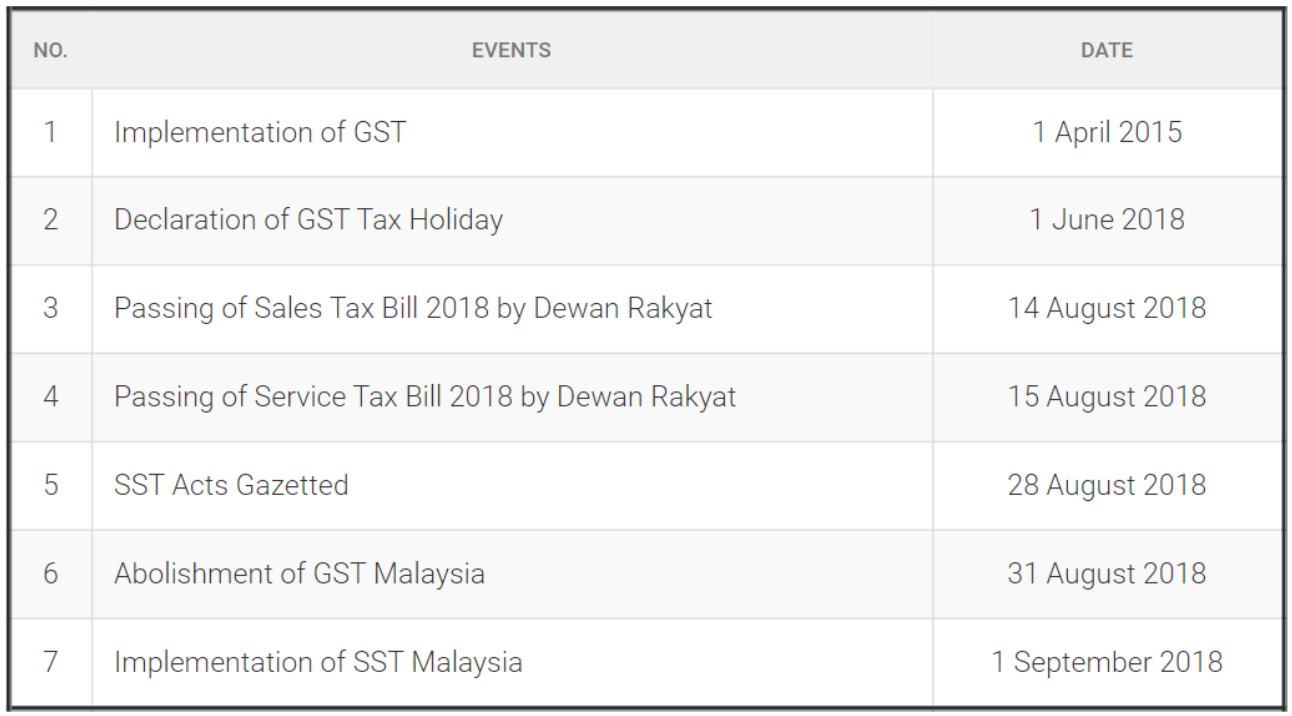

Gst In Malaysia Will It Return After Being Abolished In 2018